Across the value chain of lending, Underwriting is the most critical step — decision making at this point decides the fate of the transactions between lenders and potential borrowers. The success of this step is highly dependent on the availability of data; in the absence of reliable data, subjective decision-making kicks-in, resulting in sub-optimal results.

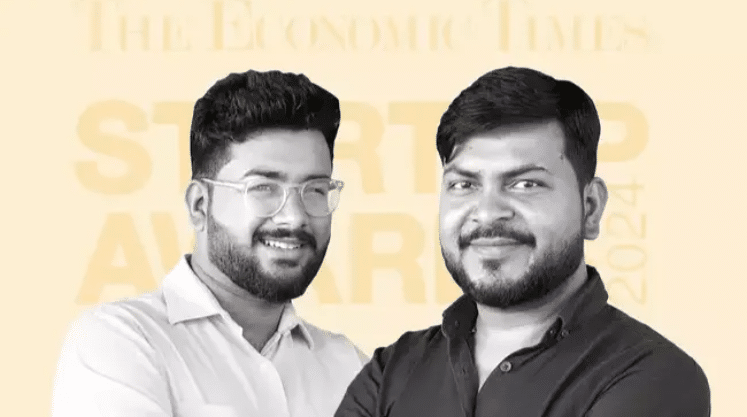

Traditionally banks and NBFCs have been dealing with underwriting using CIBIL scores and manual rules that apply data points from the borrowers’ historical credit transactions. This method, however, has flaws as well as suffers from significant time lag as it doesn’t incorporate recent changes in the subject’s socio-economic profile. In addition, this approach excludes New to Credit Customers who would potentially have much less delinquency rate than existing customers of the same lender. Our quest to find a new-age lending tool, that can help build inclusive credit offering leveraging technology, led us to Abhishek Agarwal and Rajiv Raj at CreditVidya.